- #Invoice to go 4.0 crack software

- #Invoice to go 4.0 crack license

- #Invoice to go 4.0 crack plus

- #Invoice to go 4.0 crack professional

#Invoice to go 4.0 crack plus

When done they will appear listed on the page and can be edited by clicking on the name of the API key in the list or the 'Actions' > 'Edit API key' triple dot on the right of the list, plus other actions you might need.

This is where you can set up and manage your API key - there's a link at the top to 'Add credentials'. (you can get here from the 'Credentials' menu on left) You'll probably get redirected to the billing page after enabling it but ignore that - your selected API should now be enabled and if you go back to the first URL you should see it listed at the bottom of the page (but if you click on it here you'll likely get booted to the billing page again). (you can get to that URL from the 'Library' menu on the left)įrom here you can find and enable the API you want, e.g.

If you click the pull-down you'll see a popup with all your project names which you can use to put into the above URL. If you don't know your project name try variations of the above link (shorten it a section at a time) until you see the blue banner along the top with the pull-down name of projects.

#Invoice to go 4.0 crack professional

No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.įor more information, contact KPMG's Federal Tax Legislative and Regulatory Services Group at: + 1 2, 1801 K Street NW, Washington, DC 20006.This is old but in case it helps anyone else I can still get to the following URLs without having to enter billing info Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients.

#Invoice to go 4.0 crack license

The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization.

#Invoice to go 4.0 crack software

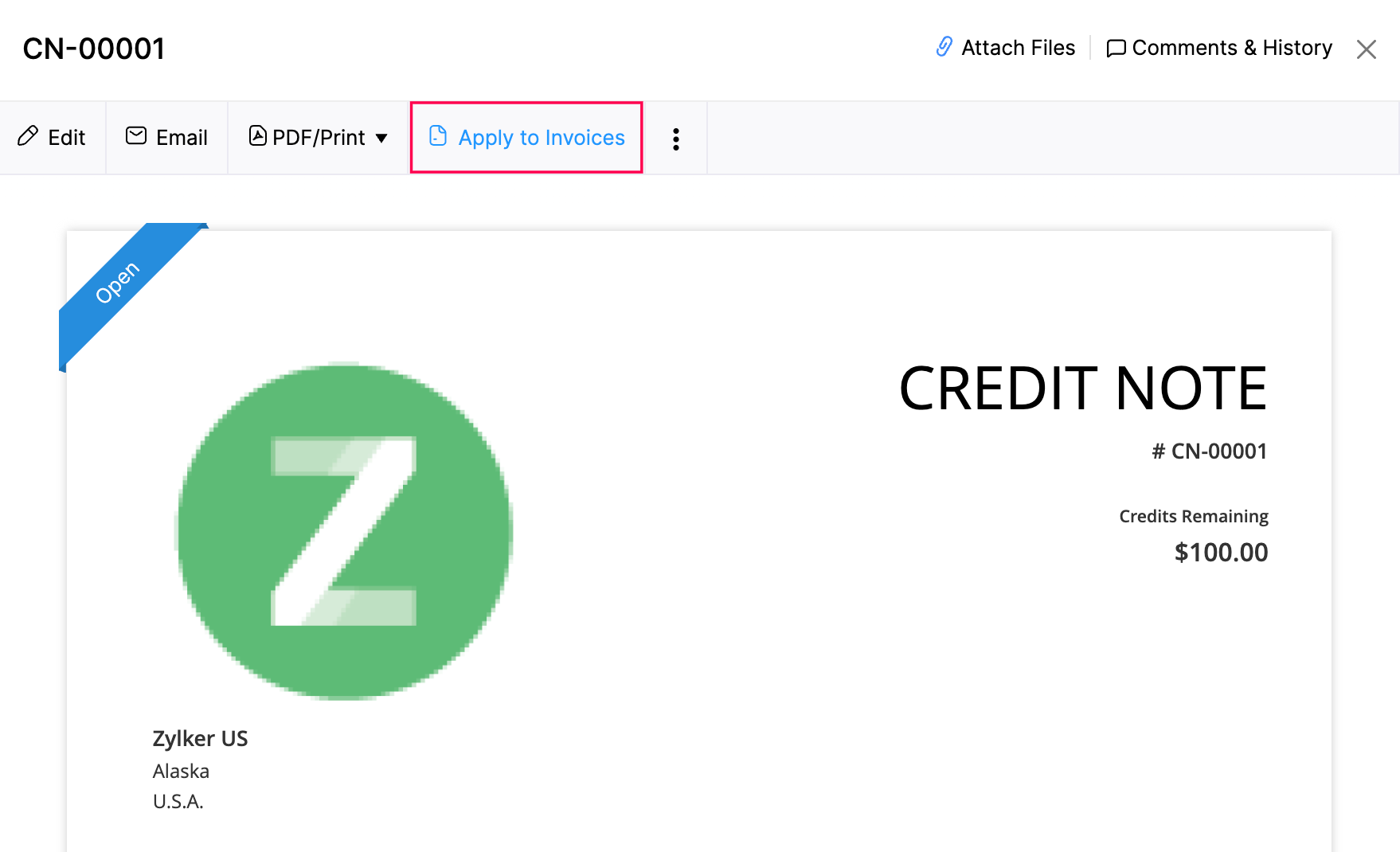

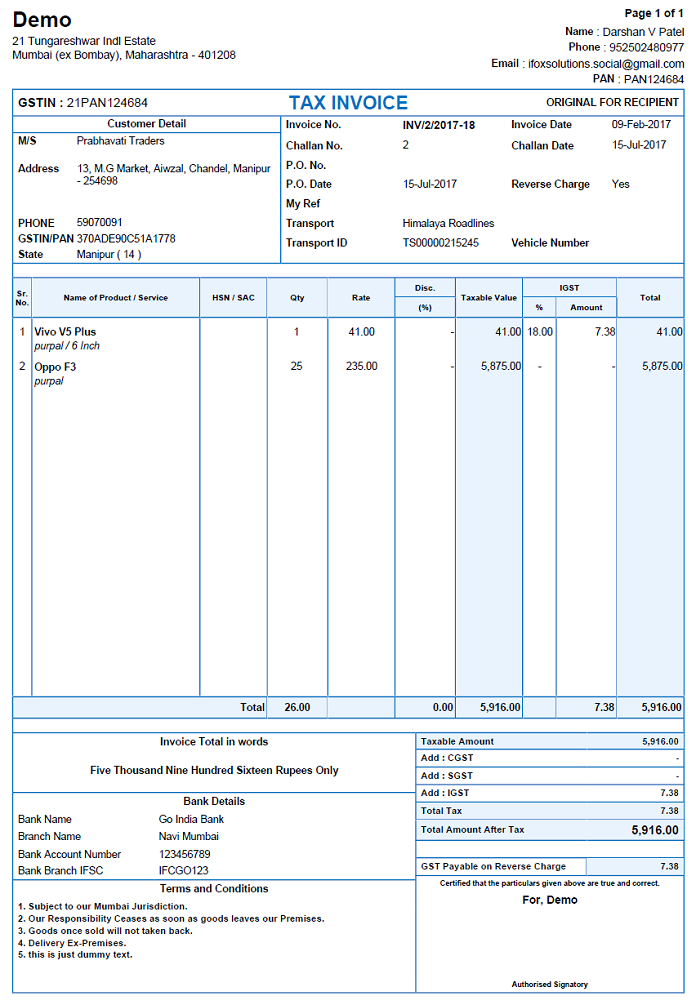

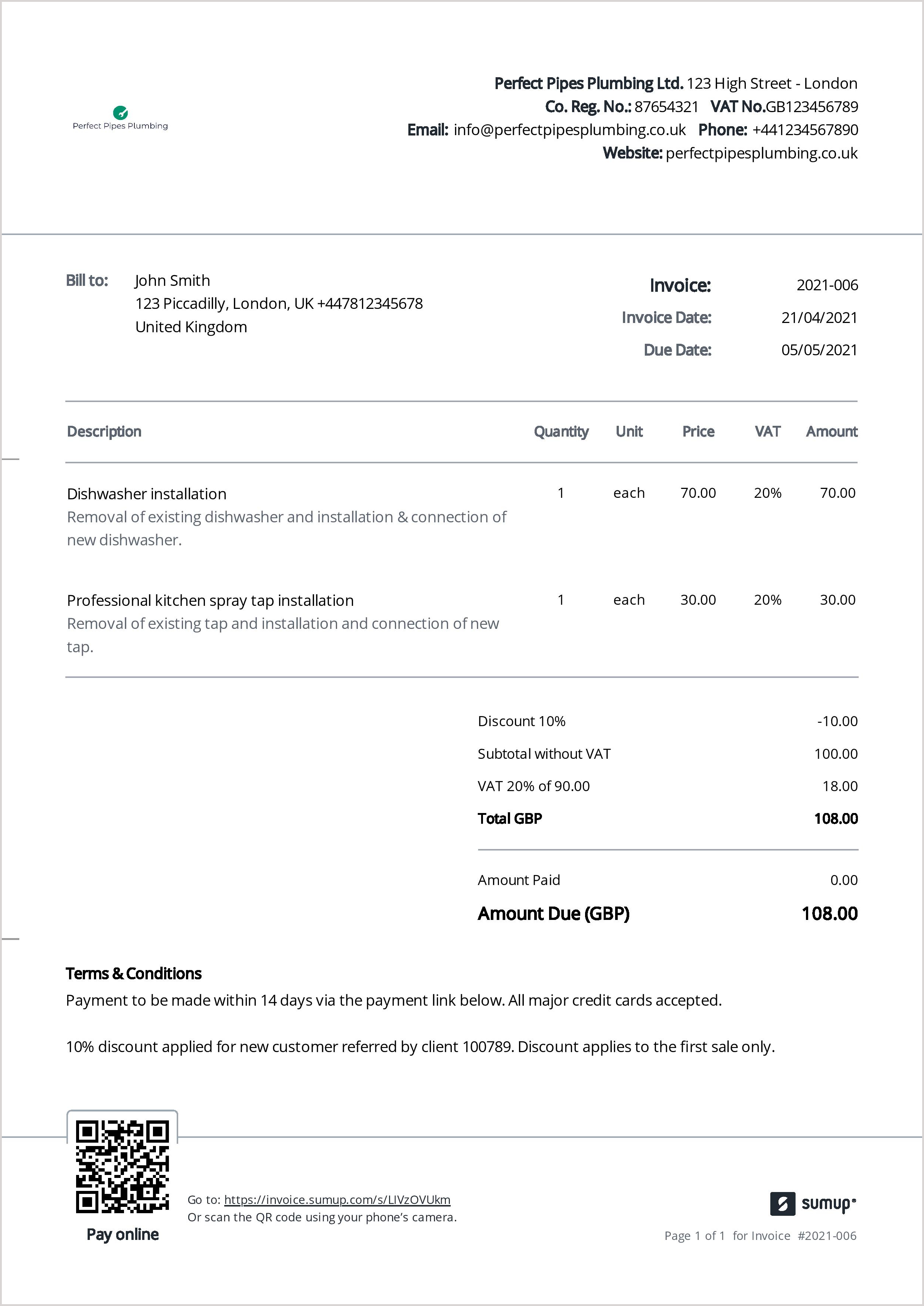

Read a June 2022 report (Spanish) prepared by the KPMG member firm in Mexico File: Invoice 4.0 Date added: Size: 27.44 MB Type of compression: zip Total downloads: 3692 Uploaded by: coalica File checked: Kaspersky Download speed: 5 Mb/s Time: AUTHOR: contbugbe Invoice 4.0 Invoice2go is the ready-to-go invoice software for creating invoices, purchase orders, quotes and all types of business documents. Taxpayers may also go to an SAT office to obtain it the proof of tax status. The last two options can be accessed from any cell phone or tablet with an internet connection. If it is required to consult or obtain proof of tax status, the SAT makes available the means to generate it remotely, which are the SAT portal, the SAT mobile application, or using SAT ID.The issuance of the payroll CFDI is independent of the obligation of employers to pay wages to their workers, and failure to deliver proof of tax status is not a reason for dismissal or withholding any payment.It is important for taxpayers to know and keep updated the information contained in the proof of tax situation, and if the taxpayer knows the information, the taxpayer can deliver it to their employer or invoice issuer without need to present proof of tax situation.This six-month extension is granted so that taxpayers can make the necessary transition process. The tax administration ( Servicio de Administración Tributaria-SAT) announced on 8 June 2022 that the new electronic invoice 4.0 (CFDI 4.0) will be mandatory as of 1 January 2023.

0 kommentar(er)

0 kommentar(er)